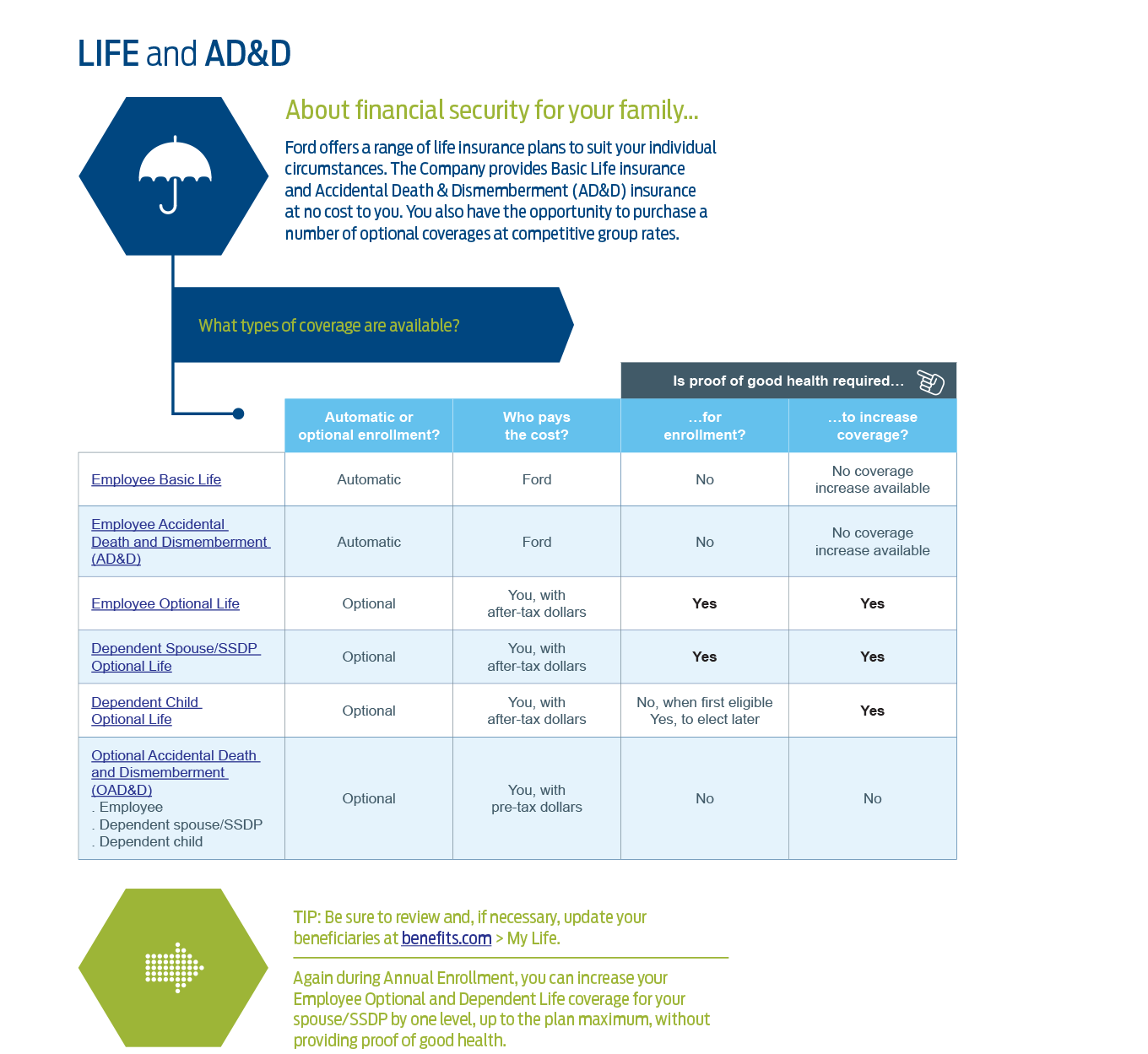

- Basic Life Insurance and AD&D. The amount of your Company-paid Basic Life and AD&D

The IRS rules state that Company-provided Basic Life and AD&D coverage in excess of $50,000 is imputed income, which means it will be included on your W-2 and that you’ll pay taxes on it. During enrollment you have the option to reduce your Basic Life and AD&D to $50,000 to avoid the additional taxable income. NOTE: If you choose the $50,000 coverage level, you won’t be eligible to elect Employee Optional Life insurance.insurance is based on your pay and salary grade. You’ll be able to review the amounts of your Basic Life and AD&D coverage during the online Annual Enrollment process.

- Optional Employee Life Insurance, which you can purchase to supplement your Company-provided Basic Life coverage.

- Optional AD&D Insurance. This coverage, which you can purchase for you and/or your eligible dependents, pays a benefit if death results from an accidental injury.

- Optional Dependent Life Insurance. You also can purchase life insurance for your spouse/SSDP and/or your dependent children.

Proof of good health is based on your responses to five questions during the online or telephone enrollment process. Depending on your responses, you may be required to complete a Statement of Heath.

For 2016, you can newly enroll or increase coverage by one level without providing proof of good health!

For 2016, you can newly enroll or increase coverage by one level without providing proof of good health!

For 2016, you can newly enroll or increase coverage by one level without providing proof of good health!

For 2016, you can newly enroll or increase coverage by one level without providing proof of good health!

For 2016, you can newly enroll or increase coverage by one level without providing proof of good health!