Complements your medical benefits by providing cash benefits for out-of-pocket expenses due to an off-the-job accidental injury. You can elect the coverage level that best fits your needs: you only, you + spouse, you + children, or family.

Complements your medical benefits by providing cash benefits for out-of-pocket expenses due a serious illness. You can elect the coverage level that best fits your needs: you only, you + spouse, you + children, or family.

Offers side-by-side quotes from some of the nation’s leading auto insurance companies. Special employee discounts are available, such as a Group discount, as well as a discount for paying your premiums through payroll deduction (if applicable). Coverage is competitively priced and is reviewed regularly to make sure the rates are among the best available in the marketplace.

Offers additional discounts for employees who enroll in both auto and homeowners insurance.

Protects you and your family from the devastation of identity theft.

From preventative care visits to significant medical incidents, VPI provides care for pets when they need it most.

A high-limit, stand-alone excess liability policy that provides protection beyond the policy limits offered by auto, home/renters, and all other personal lines of coverage. Coverage may be available up to $20 million.

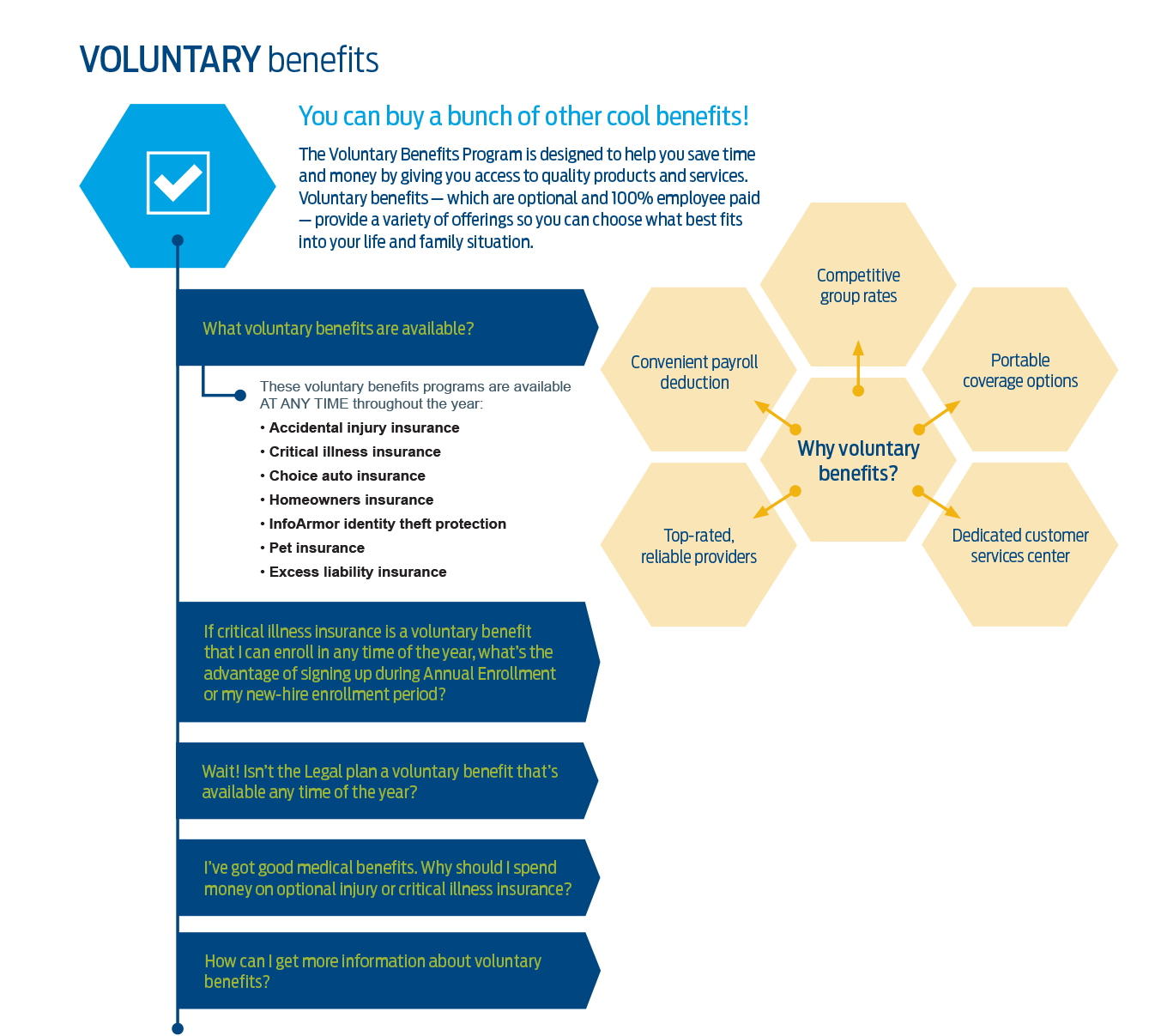

If you purchase critical illness coverage during Annual Enrollment or new-hire enrollment, you won’t need to provide proof of good health. If you sign up at any other time, normal insurance underwriting rules will apply.

Although the Legal plan IS a voluntary benefit, it’s available ONLY during Annual Enrollment or new-hire enrollment. So if you want it, be sure to get it while you can!

- Accidental injury insurancecomplements your medical benefits by providing cash benefits for out-of-pocket expenses due to an off-the-job accidental injury. Examples of covered accidental injury conditions include:Accidental injury insurance does NOT provide the same type of coverage available under the Company’s life insurance programs (AD&D and/or optional AD&D). AD&D and optional AD&D coverages provide a benefit in the event of death or certain dismemberments as a direct result of an accident. Accidental injury insurance does not require the loss of life or dismemberment. Claims are triggered based on the delivery of specified services.

You can elect accidental injury coverage for you only, you + spouse/SSDP, you + children, or you + family.

− Fracture and dislocation enhancement

− Physical Therapy

− Hospital confinement

− Intensive care

− Ambulance

− Emergency room services

- Critical illness insuranceprovides a lump-sum cash benefit for specified conditions. Examples of covered critical illness conditions include:When a critical illness occurs, most people are faced with significant additional non-medical expenditures. This benefit allows covered participants to use these funds instead of depleting their savings.

You can elect critical illness coverage for you only, you + spouse/SSDP, you + children, or you + family.

− Heart attack

− Stroke

− Coronary artery bypass surgery

− Major organ transplant

− End stage renal failure

− Advanced Alzheimer’s and Parkinson’s

− Second diagnosis of a covered critical illness or cancer

Visit benefits.com and select My Other Benefits > My Voluntary Benefits, or call Mercer at 1-800-523-2359 Monday through Friday, 8 a.m. to 8 p.m., or Saturday, 9 a.m. to 1 p.m. Eastern Time.